Wealth Planning

E.SUN Wealth Management aim at fulfilling your achievements and needs. We committed to taking care of your assets, providing consulting service with our professional team , as well as offering variety of wealth management products. We are able to tailor a comprehensive wealth management plan for you, which includes multi-currency savings, a wide selection of mutual funds, gold investment, securities, insurance, foreign ETFs, overseas bonds, and structured note.

E.SUN Expert Team

Our expert team is composed of experts from various fields, applying macroeconomic analysis to understand trends and financial movements in global markets.

The E.SUN Wealth Management Weekly ePaper is provided weekly, helping you understand world events in real time and grasp investment trends. Our experts are also available to help you adjust your investment portfolio.

Exclusive Wealth Management Consultants

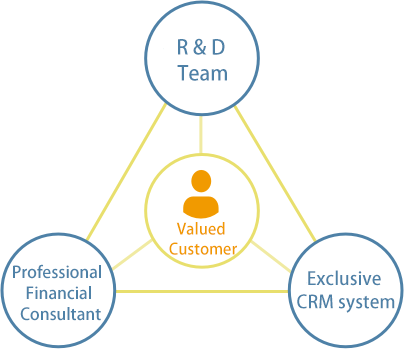

Our wealth management consultants are able to understand your plans and demands at every stage of your life. Supported by our R&D team, you are able to reach the elevated advice and direction on how your assets can be allocated, crafting the best investment strategy.

Asset Allocation and Management Systemt

Through insight into your needs and identifying the investment risks involved, we can create a complete set of plans and procedures for managing your assets, supported by our information systems and based on precise scientific calculations. At every stage of your life, we can advise you on the best asset allocation, periodically reviewing how your assets are performing and protecting your wealth.

Remote Asset Allocation Service

E.SUN Bank provides Wealth Management Express service combining professional consulting services, diversified wealth management products, and innovative technology technics. Regardless of time and space, customers can receive exclusive investment advice remotely through the mobile banking application, or personal internet banking (mobile ver.), confirm mutual fund and overseas bond/stock/ETF transactions, and adjust asset allocation in real time!

Here are three major features of the Wealth Management Express service

Fast transactions

Investment plans are not subject to time/location limitations

Adjust asset allocation in real time, anytime and anywhere.

Simple-click finance

Asset allocation can be confirmed remotely

Easily check transaction details for many different transactions through the E.SUN Mobile Banking app or personal internet banking (mobile ver.).

Easy operation

Immediately receive personalized investment portfolios

Simplified transaction processes allow you to intelligently grasp investment opportunities.

Innovative Products and Transaction Systems

To help our clients invest more disciplined, we have also continuously implemented various new innovative systems and features such as our SIP/Variable SIP Stop-Loss and Stop-Limit system and our unique Automatic Redemption and Re-Subscription Stop-Loss Stop-Limit system, which combines three different functions: our stop-loss stop-limit system, our automatic redemption function, and our re-subscription function. During times of relatively high market volatility, our stop-loss stop-limit system can be used to effectively manage profits and losses, reducing the mental burden of needing to constantly monitor the market situation. The system can also be used to set investment targets in advance, immediately executing investment orders once redemption proceeds are transferred to your account. This allows you to quickly begin participating in the market again, reducing the window of time where your funds are not being utilized, and utilizing assets much more efficiently.

Insurance Platforms

Utilizing the advantages of open banking platforms, and selecting quality insurance companies to work together with, E.SUN has designed insurance products able to meet the diverse needs of our customers and able to fit market trends. Through deep collaborations, we have continued to develop long-term, high protection insurance products, providing traditional insurance products that, despite the highly volatile and persistently low-interest market environment, offer a range of different term periods and reimbursement conditions. Paired with investment-style insurance policies which allow you to flexibly designate desired insured amounts, insurance premium levels, and investment allocations, as well as unique features such as our expert insurance management services, risk control functions, and the rich variety of different investment targets offered by us that you can link your insurance policy to, E.SUN is able to satisfy all of your insurance, investment, and asset allocation needs.

Customized Financial Products

E.SUN’s overseas structured notes business has been developed to include both principal-protected and non-principal protected frameworks, linked to the investment target’s exchange rate, interest rate, and index. In particular, products linked to short-term stocks can be linked to various listed foreign ETFs and stock investment targets, satisfying your various investment preferences. We have also continued to implement bull and bear frameworks, distributing overall portfolio risk.

E.SUN aims to provide a rich bonds investment map while also effectively managing risk. Through our rich investment options, combined with our unique risk management system, we effectively grasp the risks faced by our clients' asset portfolios.

Please see here for warnings concerning mutual fund investments.

Insurance products are provided by each insurance company. E.SUN Bank only promotes and solicits subscriptions to these products. The Policyholder shall carefully read the policy terms, product prospectus and other documents before subscribing to an insurance policy. Consumers may be adversely affected if a contract is canceled or payment is discontinued after subscription to an insurance. Please carefully select insurance products that meet your requirements. This insurance product is not covered by deposit insurance as it is not a deposit product, but it is protected by the Taiwan Insurance Guaranty Fund. Changes in the relevant tax provisions may influence the return on investment and payment amount of insurance products. Inheritance tax shall be calculated based on the principles of individual cases as recognized by the taxation authority. The exchange rate risk and the risk of political and economic changes in the country where the currency is denominated in is higher due to the long holding period of non-investment life insurance transacted in such currencies. Therefore, the Policyholder is advised to carefully consider before subscribing to an insurance policy. The insurance company reserves the right to underwrite or reject the insurance.

Insurance products are provided by each insurance company. E.SUN Bank only promotes and solicits subscriptions to these products. For all investment targets linked to insurance products, the investment performance of the issuing or management institution in the past does not guarantee future returns. E.SUN Bank is not responsible for investment gains or losses. The Policyholder shall carefully read the policy terms, product prospectus and other documents before subscribing to an insurance. Possible product risks include early redemption risks, exchange rate risk, credit risk, general market risk, legal risk and investment risk. When possible risks occur, the investment principal and minimum return are not guaranteed. The maximum possible loss is the entire investment principal. The policyholder is advised to make careful consideration before subscribing to an insurance. This insurance product is not covered by deposit insurance as it is not a deposit product, but it is protected by the Taiwan Insurance Guaranty Fund. In addition, the value of the investment assets recorded in the separate account for this insurance product is not protected by the Taiwan Insurance Guaranty Fund. Changes in the relevant tax provisions may influence the return on investment and payment amount of insurance products. Inheritance tax shall be calculated based on the principles of individual cases as recognized by the taxation authority.

If the investment target is a discretionary account entrusted to the discretionary investment business for use and management, the related asset reversal mechanism may make payments drawing on the income or principal of the account. Any amount paid out of the account may result in loss of the initial investment. The insurance company reserves the right to underwrite or reject the insurance.

Investments into foreign ETFs/stocks are not without risk, and past performance is not an indicator of future performance. No minimum return on investment is guaranteed. Foreign ETFs/stocks come with investment risk, and these risks may lead to losses to the principal investment amount, with the maximum possible loss being loss of the entire investment principal and any interest earned by this principal. Foreign ETFs/stocks are not deposits, and is not covered by deposit insurance. Thus, the Investor shall be responsible for any losses incurred. Before investing, the Investor should carefully read the prospectus. Investment targets which are stocks listed on the Shanghai (Shenzhen) stock exchanges may only be subscribed to by professional investors. Commission acceptance times for orders made via Internet banking shall be announced on the Bank’s website, but the actual transaction time is subject to the rules of each commission market exchange. Future adjustments shall be announced on the Bank’s website.

This is an investment made via a specified monetary trust into an overseas structured note product. It is not a deposit, and is not protected by deposit insurance. Although this product has been reviewed by E.SUN Bank, this does not mean that we have verified the subscription items of the overseas structured note, or that we guarantee its value. E.SUN Bank is not responsible for any investment profits and losses, and is not legally allowed to guarantee the original investment principal as denominated in the original investment currency, or minimum returns.

- Quoted prices are for reference only. The actual transaction price may differ from the quote provided by the Bank due to market variations. The trade confirmation statement shall prevail with regard to the actual transaction price and the total volume transacted.

- The Bank does not guarantee the principal, interest, and minimum return rates for any investments into the overseas bonds offered by the Bank via a specified monetary trust. These investments are not covered by deposit insurance. Important information related to these matters are as provided in the prospectus for each investment product.

- Maximum potential losses from overseas bonds

- If the issuer does not encounter a credit risk at the end of the investment term, the Investor shall in the worst case scenario receive 100% of their investment principal back, and shall also have to pay trust management fees.

- If the issuer encounters a credit risk, the Investor may lose their entire investment principal in the worst case scenario.

- Service charges from channels for investing into overseas bonds: The total annual charge, calculated as the total entrusted investment principal multiplied by the fee rate, shall not exceed zero point five percent of the principal invested into the product. Provided to the Bank (trustee) by the issuer or broker. However, the above rules do not apply to any subscriptions made by professional investors.

Due to gold price fluctuations in the international market, investment in gold may lead to profits or losses for the Investor. In the worst case scenario, the Investor may lose their entire principal. The Investor is therefore advised to make careful considerations before investing and be prepared to assume the risks involved. Gold Investment accounts are not considered deposit accounts, and are thus not subject to interest payments. They are also not covered by the Deposit Insurance Act, nor covered by the deposit insurance system. A transportation fee shall be charged when customers make physical gold withdrawals from such accounts.